The Joy of Budgets

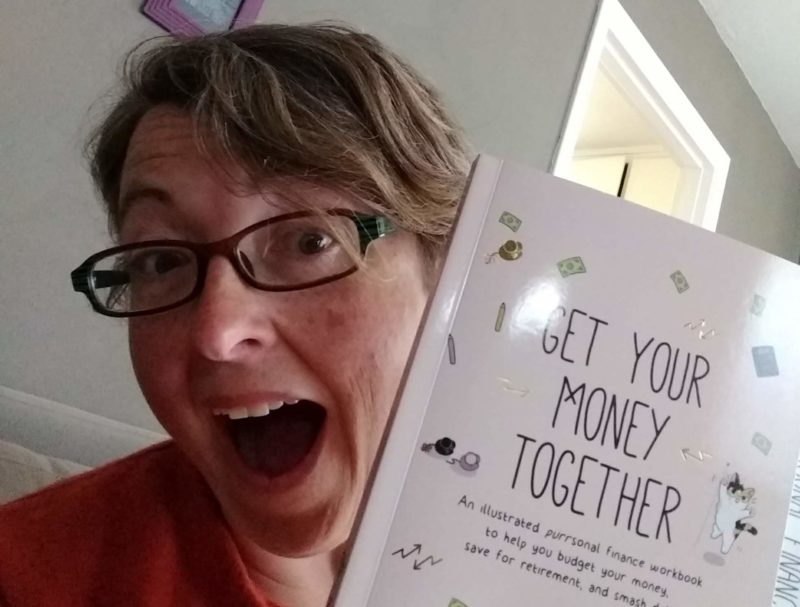

“Get Your Money Together” is a great workbook!

Friends help friends budget better, so before going any farther, I want to give shout outs to those who got me on the life-bettering path of budgeting: Esther Harlow, Heidi Guenin, and Lillian Karabaic of Oh My Dollar!

Our collective relationship to money is a strange, complicated thing. Merit is often ascribed in direct proportion to wealth, which is ridiculous and erases the role that slavery and enduring institutional racism has impacted wealth distribution. It also conveniently glosses over the gender wage gap, founded in sexism and amplified in penalizing women for childbearing. That’s just two examples of the litany of wealth distribution inequities. When talking about budgeting, it’s easy to slip into personal financial management as a morality play, and a real-time tally of one’s contribution to society. I’m really hoping to avoid that here!

I have worked in the nonprofit sector for about 13 years, a sector notorious for operating in a cycle of resource scarcity that translates to salaries that inspire pecuniary anxiety for staff. When I left my professionally rewarding but financially nail-biting position as an executive director of a small nonprofit organization, my financial cushion felt more like a camping pad with a slow, persistent leak than a trampoline. I hustled to make rent and was fortunate to stay (mostly) above water for the three months it took to secure another position. However, my credit card statement started to cause me low-grade anxiety. I wanted to stop carrying the balance (related: interest is a poor tax) and build a financial cushion that would allow me to make career choices, rather than taking a job to meet short-term survival needs.

Enter YNAB, the budgeting software/app that my budget-savvy friends suggested as a means to track spending and build different money habits. YNAB is short for “you need a budget,” and I sure did need one. One of main tenets of YNAB is that you can’t budget money you don’t yet have, and you need to give every dollar you have a job. This second rule helps you focus on long-term goals. Saving for the future isn’t a goal; but creating a 3-month expense buffer is.

Budgeting isn’t a one-time—or even a once-a-month—practice. I knew I needed to create a new daily habit using proven methods that seem to work for folks. In order to do this, I committed to spending 10 minutes budgeting every morning over my first cup of coffee for one month.

Fast forward four years. It pretty well worked! I certainly could have done some things better, but I paid off both my credit cards and created a smallish buffer for emergencies, which is cushioning my current job search (though I still need to remember to breathe, which is why meditation is now part of my daily morning routine, right before budgeting). I have goals and aspirations and can hopefully weather at least a few of the smaller vicissitudes of the unknown future.

What I learned at life today: Budgeting is an everyday practice, but it should never be forgotten that wealth as a test of merit is a gigantic con game.